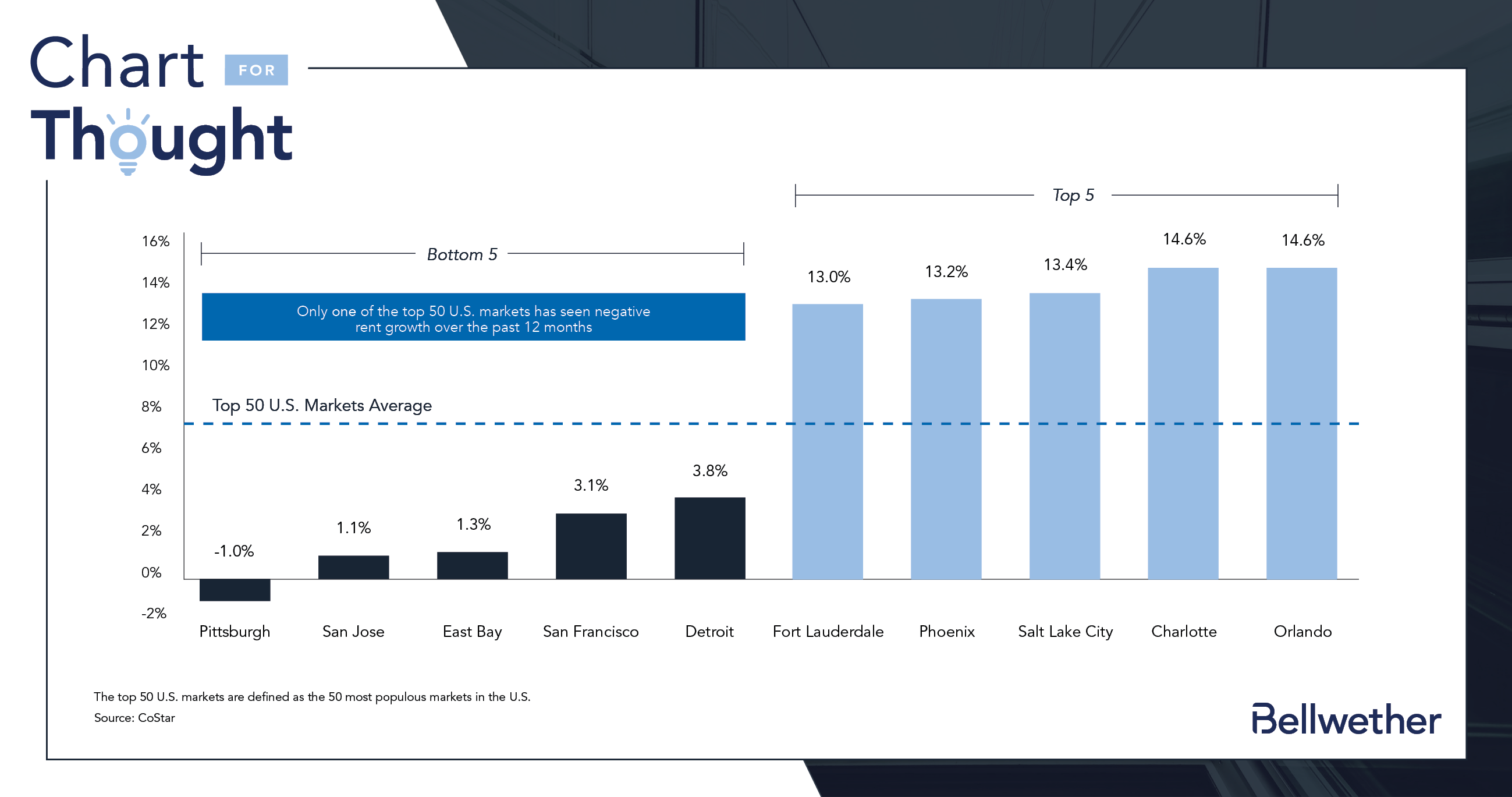

- The average annual rent growth over the past 12 months in the top 50 U.S markets for industrial was 7.7%, with only one of the top 50 markets posting a negative annual rent growth rate in the third quarter of 2023. Following the industrial sector’s unprecedented rent growth in 2021 and 2022, the ongoing rent growth across the country is noteworthy, particularly in a landscape where many sectors of commercial real estate are facing challenges.

- The continued rent growth is supported by the growth of e-commerce and the associated expansion and transformation of supply chains and distribution networks. Demand for industrial real estate is also supported by increased port volume over the past decade, as well as the U.S. government’s push to revitalize the country’s manufacturing sector through investment and incentives. The U.S. government has already invested over $500 billion since 2020 in manufacturing and clean energy initiatives, increasing manufacturing reshoring and employment, as well as demand for industrial space.

- Despite the sector’s strong fundamentals, rental rate growth has moderated from 2022 highs as supply and demand gained more balance.

- Chantalle Rochel, Vice President of Equity at Bellwether, noted that “global technology evolutions continue to prove the resilience of industrial demand through even the most challenging real estate cycles. Despite moderate net absorption totals this year, market rents continue to remain above pre-pandemic levels. While the macroeconomic outlook has put pressure on capital markets, and short-term concerns around supply/demand dynamics have surfaced, it should not deter the future growth of industrial real estate.”

Industrial Rent Growth Across Top 50 U.S. Markets