- Uncertainty surrounding return-to-office following the pandemic negatively impacted office occupancy and increased vacancies. There could be a surplus of 330 million square feet of empty office space that will not keep pace with modern use and trends by the end of this decade.[1] Concurrently, the U.S. faces its own housing shortage. Freddie Mac estimates the U.S. is short about 3.8 million units of housing.[2]

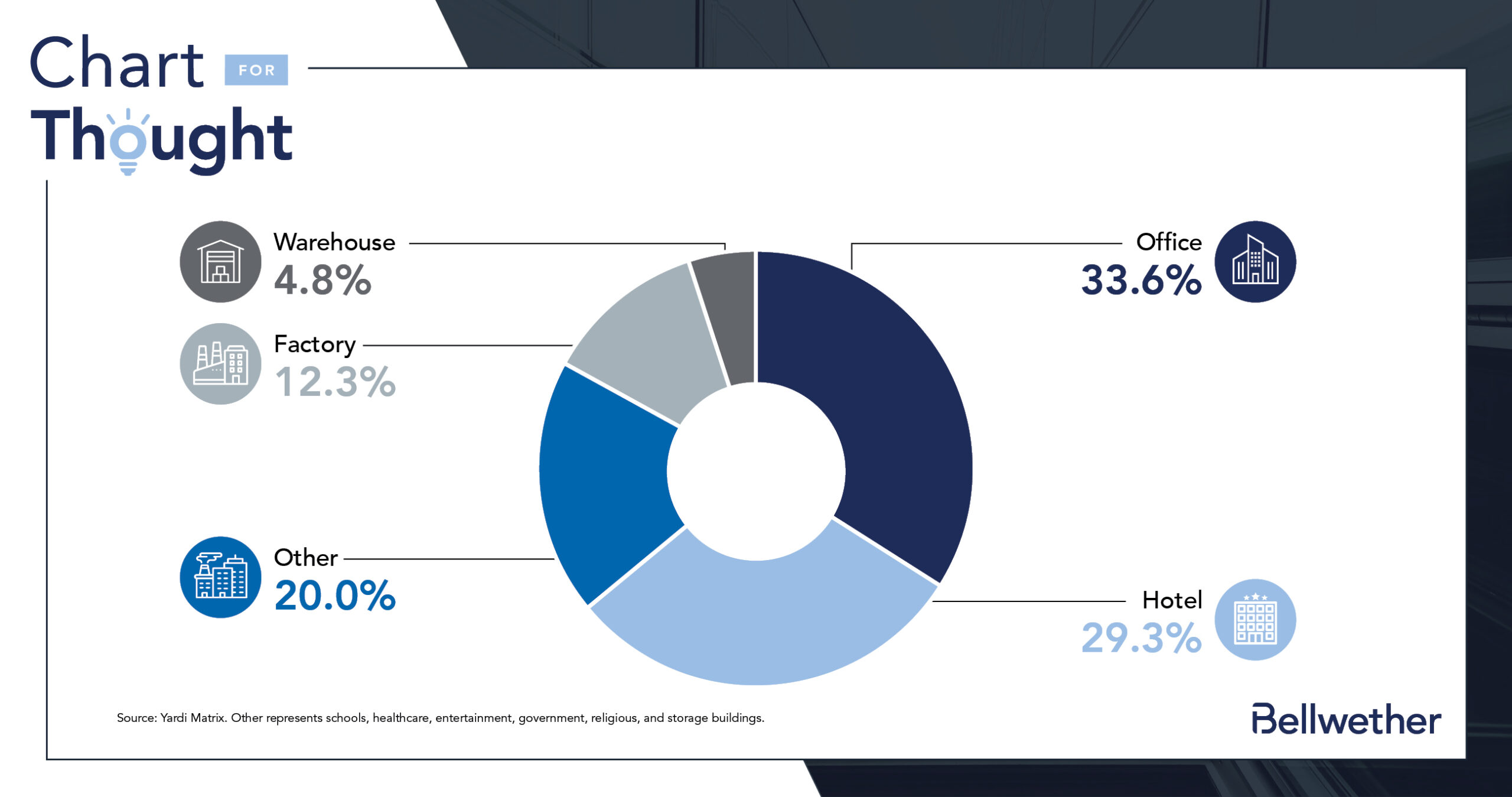

- In 2022, 10,090 apartment units were converted from alternative building types. Office-to-multifamily conversions led the list with 34%, followed by hotels at 29%.[3] Adaptive reuse, or repurposing of an existing building for new use, can be an option for these empty office properties. However, there are hurdles to acknowledge that make these type of conversions quite challenging:

-

- Building Configuration – not every office building is a good candidate for conversion. The building’s core layout should have good access to light and ventilation, with open, shallow floor plates. These are often attributes of older, smaller buildings that were built prior to 1980. When considering conversion candidates in U.S. metros with the most vacant downtown office buildings, the results are also scarce with only 1.1% of total office space on the market qualifying.[4]

- Time to Convert – the conversion process is lengthy and cumbersome. Generally, local zoning codes prohibit residential uses in commercially zoned areas. Proper permitting and entitlement can take 2 to 5 years (varies by jurisdiction). And if approved, another factor to consider is that redevelopment on the building can take between 8 to 16 months[1] to complete, further adding to the project timeline.

- Costs – the costs of conversion are expensive. The scope of work is estimated to cost between $100 to $500 plus per square foot.[4] Furthermore, investors and developers face financing constraints today. The pullback of traditional lending sources has limited the ability for borrowers to obtain financing, while the rise in interest rates substantially increased cost of capital associated with redevelopment. Daniel Fine, senior vice president at Bellwether also remarked, “An investor typically underwrites a specific business plan at acquisition, inclusive of all tenant-related costs. It’s challenging to pivot midway through a hold period especially if long-term office leases are signed which can result in expensive lease buyouts, further escalating conversion costs.”

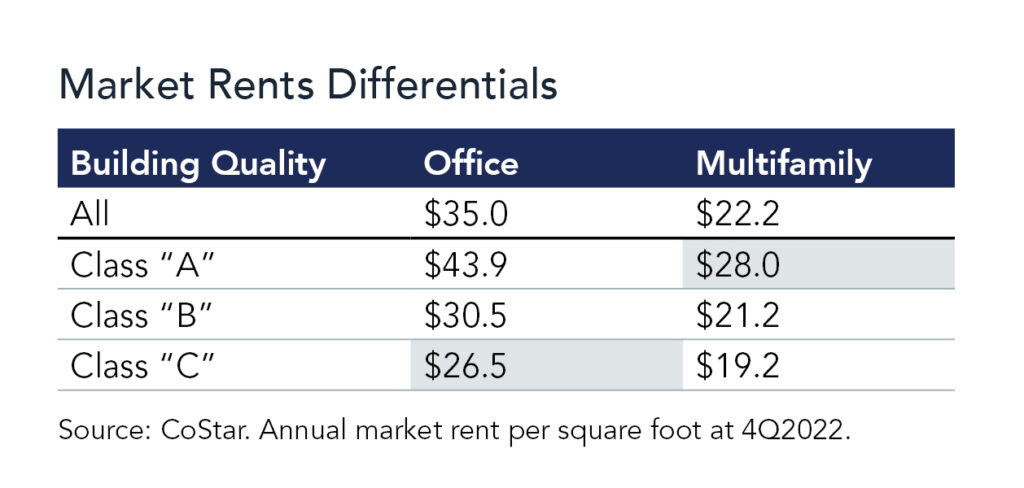

- Lastly, when observing market rents per square foot for office and multifamily in 2022, the difference between the two was too wide to warrant conversion; except when possibly converting class “C” office to class “A” multifamily. “In certain markets where office demand has dried up, class “A” office buildings could pencil into multifamily given the compelling basis of vacant office buildings,” added Carolyn Leslie, managing director at Bellwether.