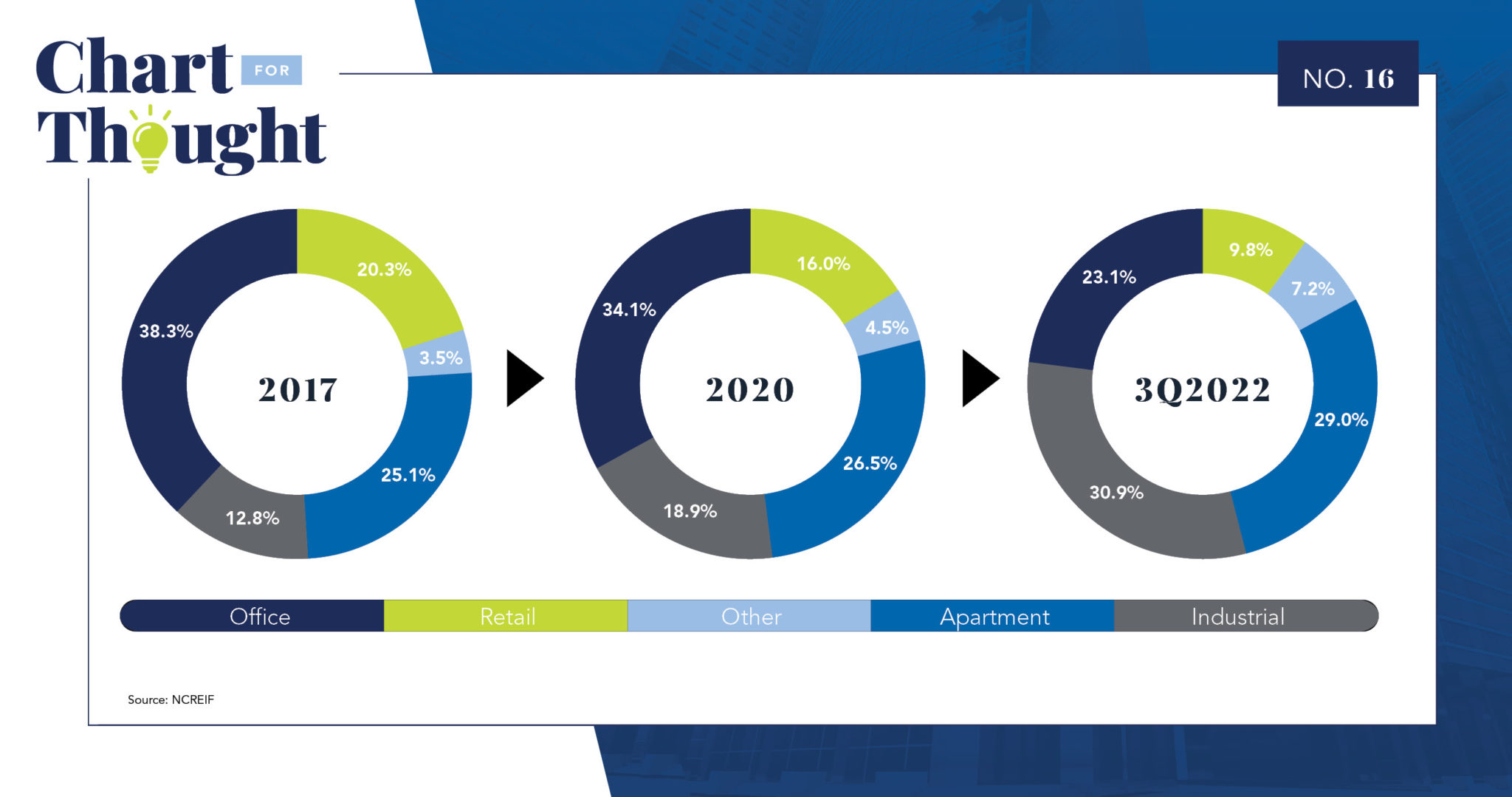

- ODCE funds pursue core investment strategies that are characterized by stabilized assets with lower leverage. Historically, these funds have taken overweight positions in office and retail. However, recent headwinds in those sectors have encouraged a shift to industrial and multifamily investment.

- Over the previous five years, ODCE allocations shifted significantly: Industrial rose from 12.8% to 30.9%, Apartment rose from 25.1% to 29.0%, Retail shrank from 20.3% to 9.8%, and Office fell from 38.3% to 23.1%. The bulk of this shift occurred in only the last two years as the COVID-19 pandemic intensified ongoing trends.

- The shift in capital flows fueled competition for quality industrial and multifamily assets. The influx of capital helped raise values and compress cap rates in those property types.

ODCE Allocation Shifts