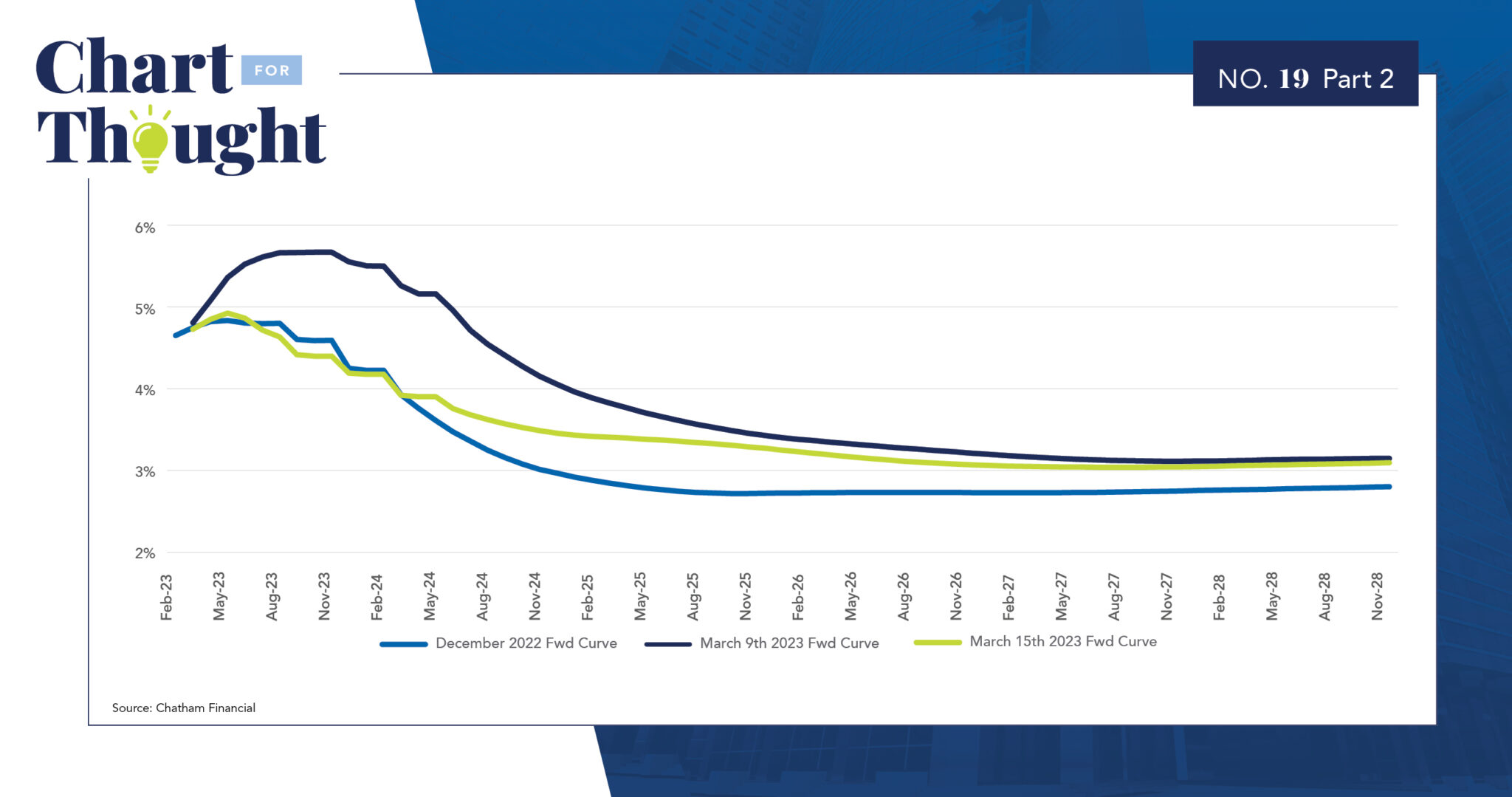

- The forward curve of benchmark rates for real estate loans, such as 1-month term SOFR, serve as the market’s prediction for where the Fed will pause hiking and the shape of potential Fed cuts as inflation declines further and/or the economy sputters

- The expected terminal rate for the Fed during this hiking cycle ratcheted up between December 2022 and March 2023 after CPI and jobs report readings suggested that a tight labor market may keep inflation levels elevated

- At that time, the curve pointed to the Fed inching closer to a benchmark rate in line with CPI and then gradually cutting rates alongside further declining inflation

- However, by mid-March news of the collapse of Silicon Valley Bank ignited concerns of how the banking sector would be impacted and if increased volatility could be expected in the near term. In response, the market outlook adjusted the forward curve towards fewer rate hikes and earlier rate cuts

- Silicon Valley Bank’s difficulty navigating higher rates and the tightening economic conditions imposed by the Fed will undoubtedly be on the minds of the Open Market Committee as they determine how to proceed in their fight against inflation and balance that with the health of the economy

1-Month SOFR Forward Curves