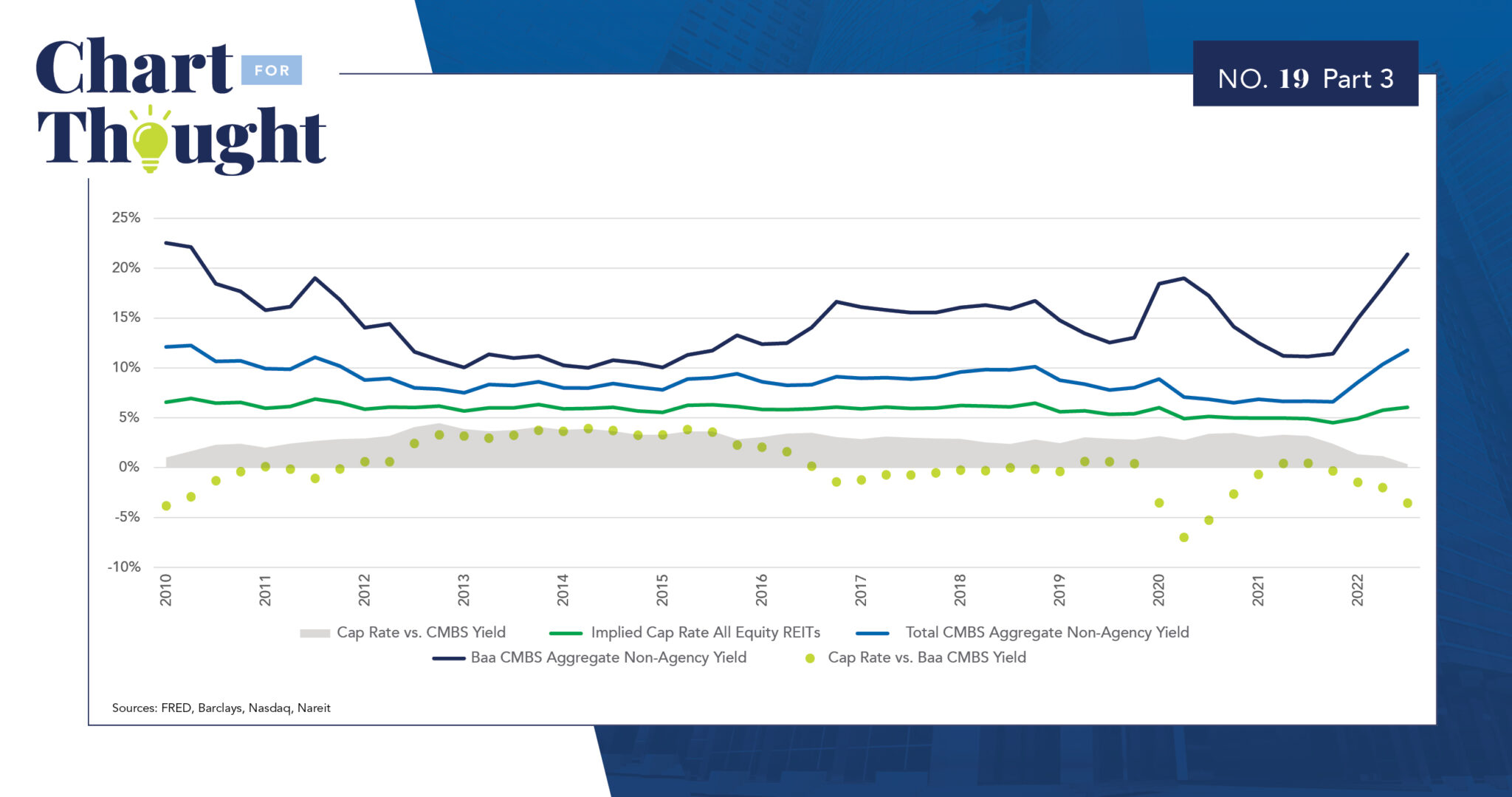

- Turning to real estate and zooming in on the period after the Great Financial Crisis, there are several notable observations

- The spread between CMBS yields and unlevered cap rates have tightened to near zero

- Baa rates for CMBS yields (in general, a more “equity-like” tranche within a CMBS pool given higher risk of loss) trade at a significant premium to REIT cap rates

- While the Baa CMBS yield spread over cap rates has not blown out to the extent seen during the post-COVID, pre-stimulus period, they resemble the spreads seen coming out of the Great Financial Crisis

- At the yields available for Baa-rated CMBS debt, the fixed-income market points to greater potential volatility than the REIT market

- At the yields available for Baa rated CMBS debt, the fixed income market points to more distress than the REIT market (albeit a different composition of properties, with REITs often using less leverage than a typical CMBS financed asset, may make REITs seem less risky than the 40-60% leverage tranche within a CMBS pool)

- The typically “core to core-plus” profile of REIT holdings and the limited use of leverage may be producing lower cap rates than the 30%-40% CMBS tranche with private market exposure

- While going-in debt yields may look attractive relative to going-in cap rates, there remain benefits to playing on the equity side of a property’s balance sheet:

- Access to long-term fixed-rate debt and opportunity to lower volatility by setting leverage at low and/or well-covered levels

- Potential for passive value appreciation from either rent growth or cap rate compression

- Ability to generate value through actively managed business plans to improve properties

Questions for Consideration:

- Does the short-term rate’s forward curve represent an adequate forecast you would feel comfortable making decisions off of?

- Does the ability to capture upside through an equity investment outweigh the opportunity to earn going-in yields equivalent or in excess to equity yields?

- Are fixed-income real estate yields properly factoring in losses that may grow if commercial real estate distress worsens?

- What level of stability in economic data or confidence in the Fed rate path will re-ignite private market transaction volume?