- Electric vehicle (EV) owners “refuel” their cars by charging at places like retail centers, at the office, and at home. The rollout of robust EV charging networks will play a critical role to support growing consumer demand thus providing opportunities for commercial real estate property owners to benefit from

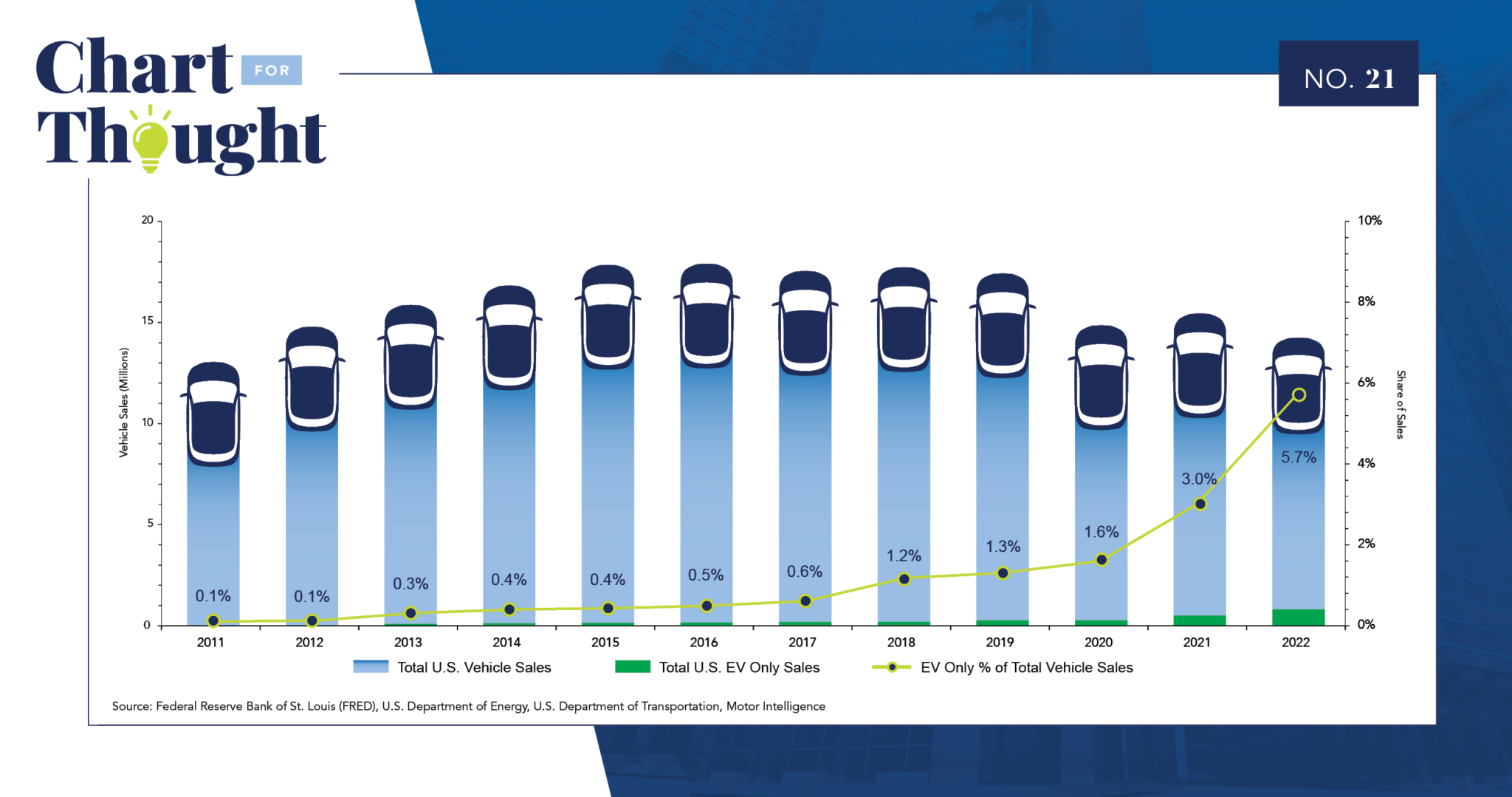

- EVs can be categorized as hybrid electric vehicles (HEV), plug-in hybrid electric vehicles (PHEV), and battery electric vehicles (BEV), also known as full electric. For this chart’s purpose we will refer to EVs as full electric vehicles but wanted to note that both PHEVs and BEVs share a common plug-in charging feature. In 2022, 14mm cars were sold in the U.S. and EVs comprised about 800k of that total. The share of EVs sold increased from 0.1% in 2011, to 5.7% in 2022, resulting in many more electric vehicles on the road today

- Global investment in EVs and EV charging infrastructure is forecasted to be half a trillion dollars through 2030 as many countries have set out zero-emissions goals. In the U.S., Congress passed the Bipartisan Infrastructure Deal in 2021 to invest $7.5bn to increase the number of EV chargers to 500k and increase EV market share to 50% in the span of five years[1]. Their aim is to provide convenient charging where people work, shop, and live

- There are three types of EV chargers in use today. Level 1 (110-volt) will add between 2 to 5 miles for every hour of charge. Level 2 (240-volt) will add between 10 to 30 miles for every hour of charge and are commonly seen in office, retail, and multifamily properties. Direct circuit (DC), or fast chargers, will add between 100 to 200 or more miles usually in 30 minutes of charge. Data from the U.S. Department of Energy approximates there were only 144k EV chargers in the U.S. at the end of 2022. California had the largest number of chargers at 43k (30% of the total), followed by New York (9k), Florida (7k), Texas (6k), and Massachusetts (5k)

- By implementing EV chargers within commercial real estate properties, it not only puts property owners ahead of the electrification trend but also provides an appealing amenity for tenants

- The U.S. multifamily sector is made up of an estimated 44mm residents, or 31% of U.S. housing[2], and 80% of EV owners rely on charging at home[3]. By offering EV charging for residents, the likelihood of retaining and attracting a sizable demographic that reside within these properties that own an EV or are amongst the population making the shift, remains high

- Kyle Chin, equity associate at Bellwether Asset Management further emphasized, “Given the growing levels of EV adoption, the Bellwether team has overseen the installation of several EV charging stations at multifamily properties, and continues to actively evaluate opportunities to meet the increasing demand. The ability to provide multifamily residents convenient access to charge their EV is a competitive advantage and added amenity that eliminates the need to go offsite to a public charger, which helps attract and retain residents.”

- For retail properties, EV charging offers the convenience for EV owners to charge while they shop, which can help to increase retail foot traffic

- As more workers are called back into the office and will need to commute, EV chargers on site provide the ease for office tenants to charge throughout their workday, but can also serve as an attractive tool for leasing

- The U.S. multifamily sector is made up of an estimated 44mm residents, or 31% of U.S. housing[2], and 80% of EV owners rely on charging at home[3]. By offering EV charging for residents, the likelihood of retaining and attracting a sizable demographic that reside within these properties that own an EV or are amongst the population making the shift, remains high

- Furthermore, on the ESG (environmental, social, and governance) front, “For properties pursuing environmental or sustainability goals, having EV charging infrastructure contributes towards green building certifications like LEED (Leadership in Energy and Environmental Design). A globally recognized certification promoting environmentally conscious building design and features, and increasingly attracts tenants and investors,” remarked Malcolm Au, ESG analyst at Bellwether Asset Management

[1] The White House, “Fact Sheet: The Bipartisan Infrastructure Deal,” November 2021.

[2] National Association of Home Builders, “2019 U.S. Census Bureau American Housing Survey,” 2023.

[3] U.S. Department of Transportation, “Individual Benefit of Rural Vehicle Electrification,” February 2022.v