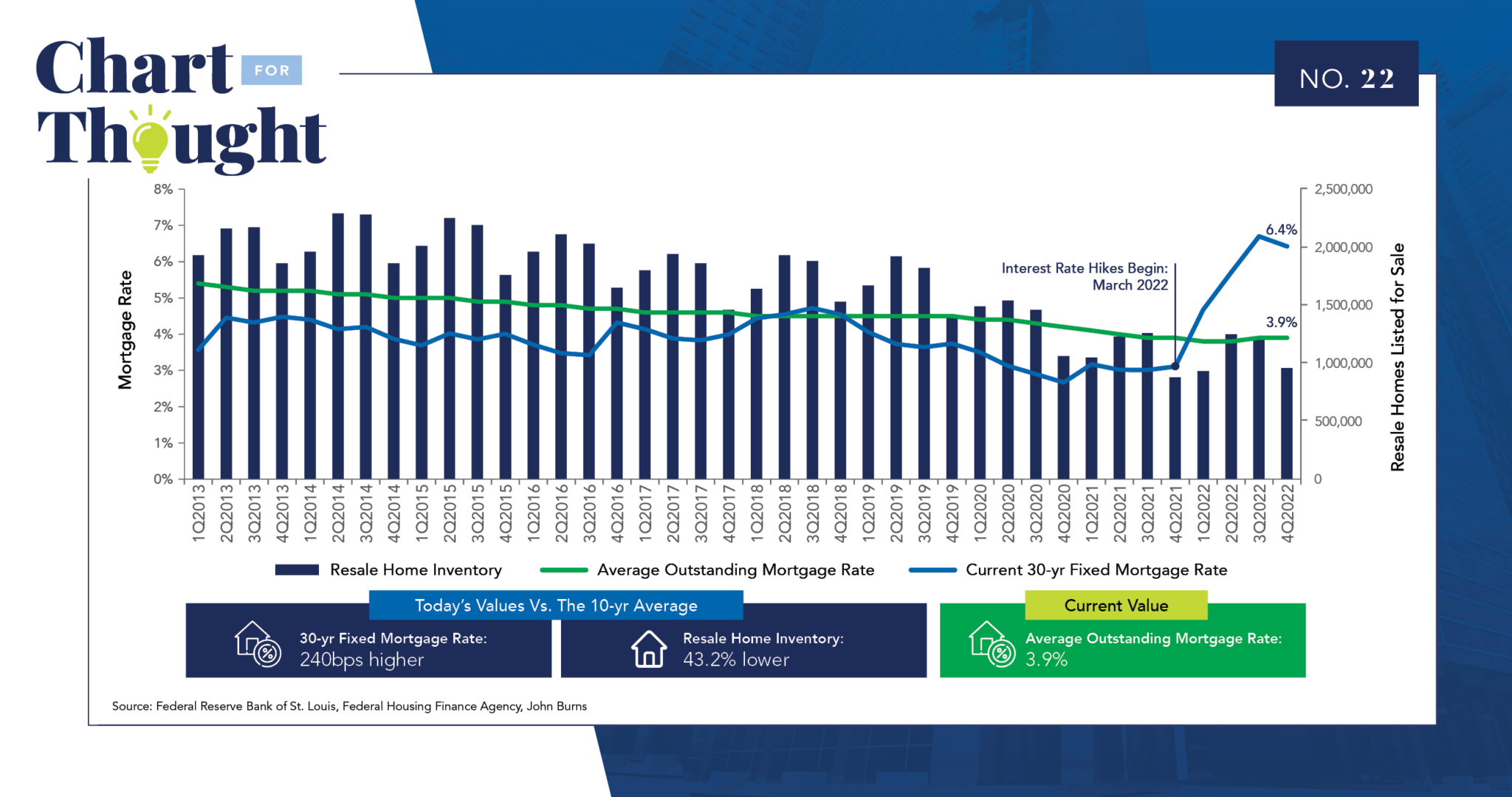

- Higher interest rates have not only played a role in making the cost of a home mortgage more expensive, but also contributed to a reduction in the number of existing homes listed for sale. The number of existing homes listed for sale is near the historical low set in the midst of the COVID-19 pandemic, and home mortgage rates are higher than at any point in the last decade.

- How are interest rates and home inventories related?: Over the last ten years, the rate on a 30-year fixed rate mortgage averaged 4.0% – significantly lower than 6.4% at the end of 2022. Most people who bought a home prior to the Federal Reserve interest rate hikes in 2022 were able to secure mortgages well below today’s rates. If the average homeowner were to sell their home and look for a new one today, then their cost of financing would be significantly higher. The higher cost is steering homeowners away from selling and therefore restricting the number of homes for sale.

- Here is an example: The most recent data from the Federal Housing Finance Agency reports that the average interest rate for outstanding home mortgages was 3.9% at the end of 2022. At that moment in time, the average 30-year fixed-rate mortgage was quoted at 6.4%. If you were to buy a house at the median price of $380,000 for an existing home at a 6.4% mortgage rate, then your monthly payment would be $2,377. That same house at the average rate for outstanding mortgages of 3.9% would result in a $1,792 monthly payment. That is a 32.7% difference! This doesn’t include the fact that existing home prices are approximately 40% higher today than at the end of 2019.

- The impact of this example, on a macro scale, results in potential sellers keeping their homes off the market even when they prefer a different home. This restricts the supply of existing homes for sale. Potential home buyers are then pushed toward the purchase of newly built homes or pushed toward renting apartments and single-family homes for longer, as they delay home purchases.

- A drawback of newly built homes is that they are often further away from job centers, where homebuilders have better access to developable land. However, remote work might make this option more amenable to buyers. Many builders are currently offering rate buydowns, so those that do purchase a newly built home can potentially feel less pain in their monthly payments.

Mortgage Rate Impact on Resale Home Inventory