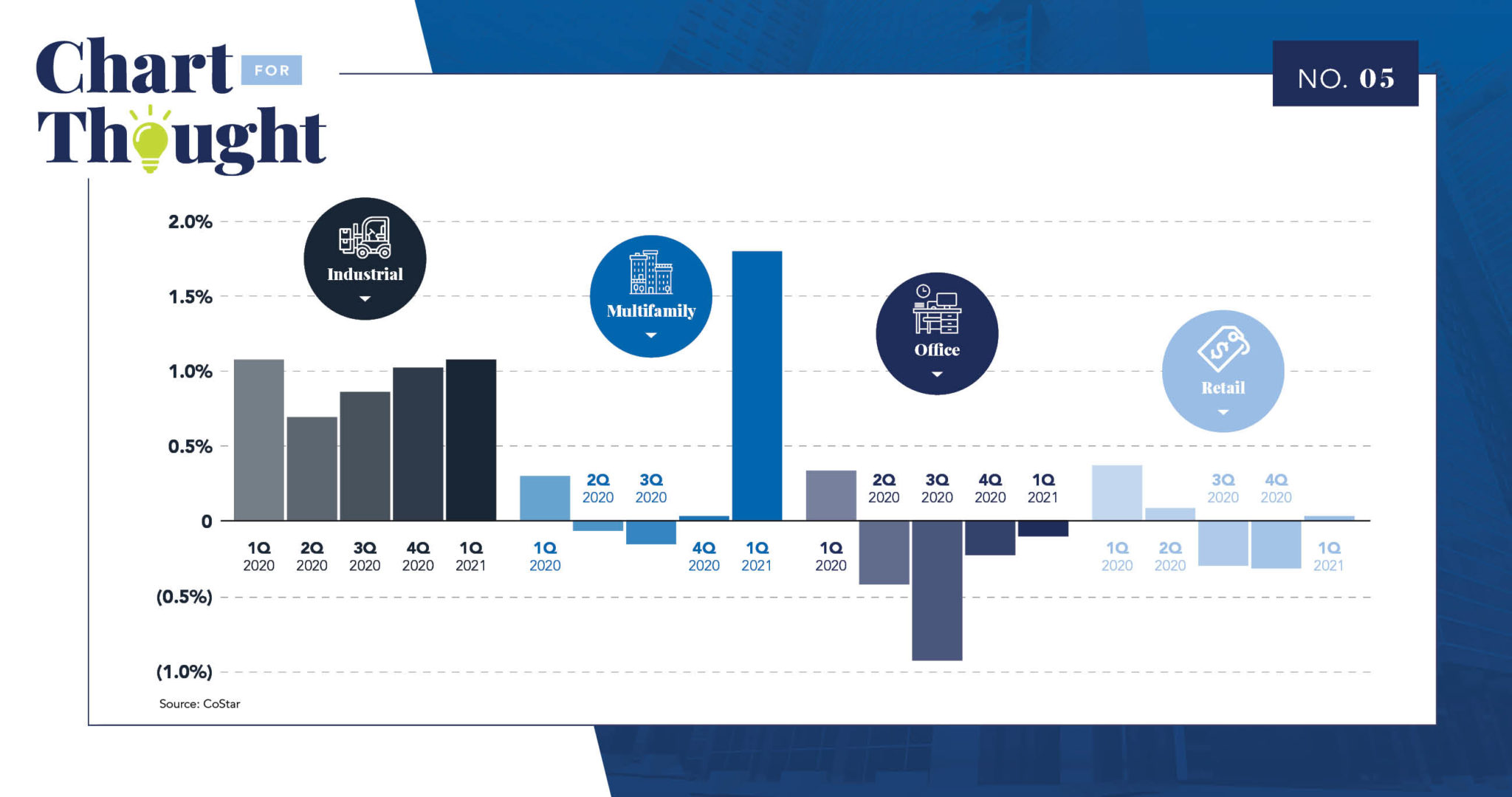

- Industrial: Rent growth remained impressive throughout the last 12 months. Rents were largely supported by increased demand for logistics and distribution space, which only accelerated throughout the Covid-19 pandemic. E-commerce sales grew 32.1% over the past year and currently make up 14.0% of all total retail sales. Investors are flocking to industrial due to this strong rent growth, and high-quality assets in top locations can demand cap rates in the 3-4% range.

- Multifamily: Back in 1Q 2020, many owners were just trying to preserve multifamily occupancy in uncertain times and did not bump rents. Now as the economy has rebounded, some owners are accelerating rent increases to bring tenants back up to market.

- Office: Limited tenant demand and a surge in sublease space placed downward pressure on office rents since the start of the pandemic.

- Retail: Rents fell in mid-2020, as consumers were confined to their homes and shifted spending to online delivery rather than brick-and-mortar stores.

Quarterly Rent Growth by Property Type