- Elections are major events that continually occur throughout the world. In the U.S., the presidential election is the most significant and occurs every four years. While these political events can create uncertainty about the country’s future, their impact on transaction activity for commercial real estate is less clear.

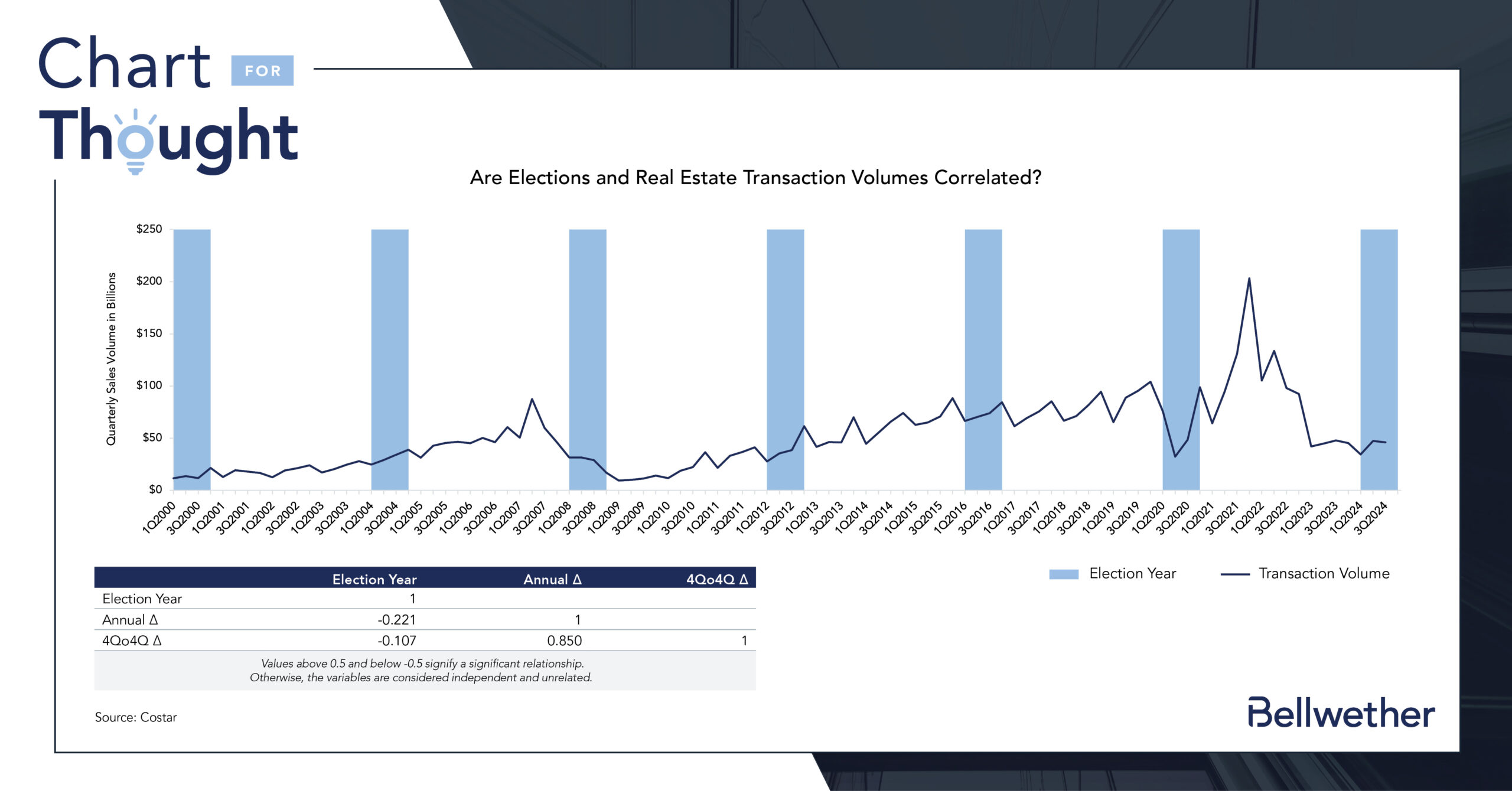

- Combined quarterly transaction volume for office, multifamily, and industrial assets since 2000 shows no consistent pattern during election years. Some election years saw positive changes in transaction volume, while others experienced negative changes.

- Statistical testing reveals no significant correlation between election years and the volume of real estate transactions. This suggests that the U.S. election cycle is not a reliable predictor of commercial real estate transactions.

- We also checked correlations post-election and based on whether the winner was a republican or democrat. None showed a significant relationship.

- Instead, commercial real estate transactions are primarily driven by market dynamics such as:

- Interest rates: Lower interest rates lead to a lower cost of capital and generally greater availability of capital for real estate transactions

- Economic growth: Economic growth generates greater demand from the users of real estate

- Investor sentiment: Positive sentiment can lead to more optimistic valuations and increased confidence when transacting

- Real estate fundamentals: Strong fundamentals like rent growth, high occupancy, and net operating income growth can improve current and potential real estate returns and attract capital flows from investors

- In conclusion, these factors have exhibited a more direct and measurable impact on transaction volumes throughout history compared to election cycles.

Elections Vs Transaction Volumes