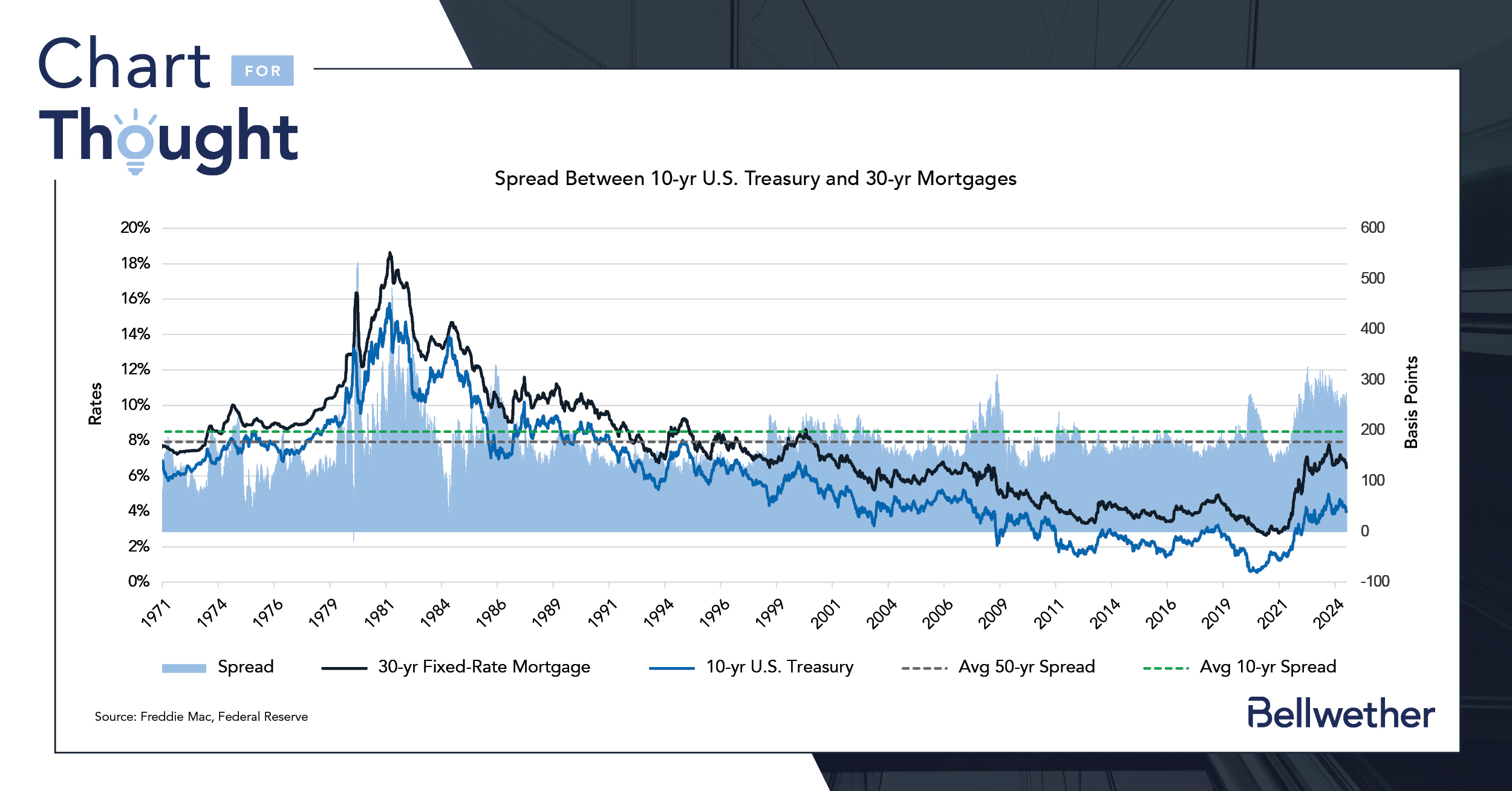

- At the start of August 2024, the average 30-year fixed mortgage rate stood at 6.73% according to Freddie Mac. At the same time, the 10-year U.S. Treasury had a market yield of 3.99%.

- The 274-basis point spread between the two was nearly 100 basis points above the 50-year average spread of 178 basis points and approximately 75 basis points above the 10-year average spread of 198 basis points.

- The elevated spread indicated an assessment by market participants of uncertainty in the U.S. mortgage market. The 10-year Treasury rate is commonly referred to as the risk-free rate, and spreads between market yields and the 10-year Treasury are a gauge of risk within market offerings. In the past, spreads on mortgages have risen above the average at times of economic recessions.

- The causes of the expanded spread today are multi-faceted and include, but are not limited to, rate volatility which is creating term risk, and a perceived increase in the risk of default based on current affordability and inflation pressures.

- If the spread returned to its 50-year average, then the 30-year fixed mortgage rate would be 5.77%, whereby the monthly payments on a median-priced home purchase would be 10% lower (a reduction of $232/mo), all else equal. Today the market is also projecting roughly 100 basis points of cuts to the federal funds rate by the end of the year, which could lower the 10-year Treasury yield and the 30-year mortgage rate, especially if rate cuts occur faster than market expectations. Reductions in the 30-year mortgage rate would benefit homebuyers by improving affordability and potentially releasing more inventory into the market.

Mortgage Vs Treasury Spread