- Between the end of 2020 and 2021, the multifamily market experienced widespread rent growth that rocketed well above the average annual growth rate. Many markets had annual rent growth in the double digits compared to the 2010-2020 average of 2.3%.

- Over the course of 2021, the highest growth regions were in the “sunshine” states across the southern United States. Markets with the strongest year-over-year rent growth, like Las Vegas, Tampa and Orlando, typified the trend with strong in-migration generating high levels of demand for housing.

- Since then, annual rent growth has reverted towards the mean. Many of the high-growth markets began to see accelerated supply growth that reduced pricing pressure. The top three growth markets in 2021 had new deliveries averaging 4.5% of their total inventory in 2024, whereas the bottom three growth markets in 2021 had new deliveries averaging 2.3% of their inventory in 2024.

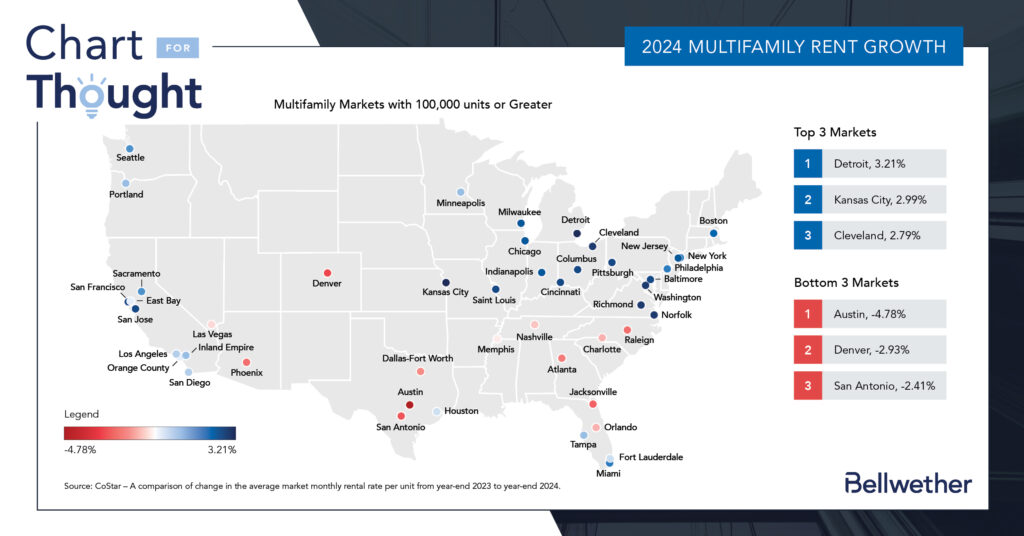

- Today, many of the markets that experienced slower rent growth between 2020 and 2021 are seeing stronger rent growth than the previous high-growth markets from four years ago. Detroit, Kansas City, and Cleveland (which ranked 31st, 37th, and 39th in rent growth in 2021) led annual rent growth at approximately 3.0% in 2024 as they caught up to nationwide increases that reset average rents higher. Alternatively, rent growth leaders in 2021, like Las Vegas and Orlando, experienced negative rent growth in 2024 as supply growth outpaced demand in those markets.

- However, the recent surge in construction that occurred in many high-growth markets is already easing. Many of the projects under construction have already delivered and are being absorbed by the market. Additionally, new multifamily construction starts have dropped significantly in 2024, which has caused the supply pipeline to shrink considerably in most markets.

- The shocks of 2020 are still making their way through the system. Supply and demand continue to rebalance to an equilibrium, that will likely result in a regression to a long-term national average rental growth rate between 2% and 3%.