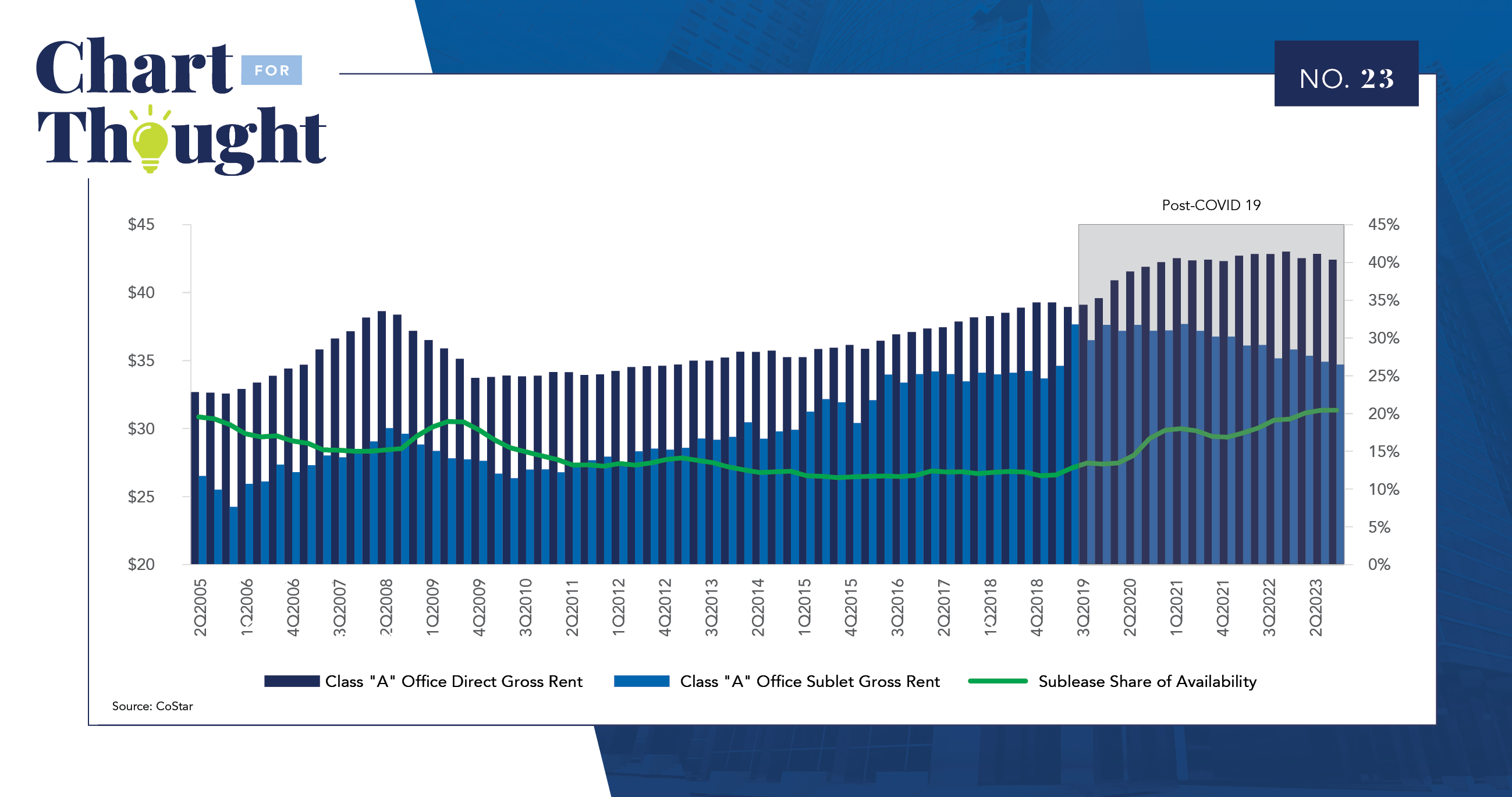

- Sublease space may pose less of a risk to class “A” market rents than initially anticipated

- The rise of remote work caused tenants to reconsider their office footprints, and some tenants made the decision to list a portion, or all, of their existing space for sublease

- Since the onset of the COVID-19 pandemic, the amount of class “A” sublease space on the market rose from 2.0% of total inventory to 4.7% of total inventory, more than doubling on a square footage basis

- As more class “A” sublease space became available at discounted rates, owners of office assets worried that the competing sublease product would siphon tenant demand away from their higher priced direct listings

- However, asking rates of direct listings remained static in recent quarters, even as sublease availability increased materially. On the other hand, an increase in sublease space for lease has correlated with a decrease in sublease rental rates

- The limited impact on the pricing of direct rents could be because tenants leasing at class “A” buildings are seeking bespoke space that caters to their needs. Limited demand for office space has also placed tenants in a position of power when negotiating with landlords, so they are likely to get favorable concessions including high-end buildouts and other perks when negotiating leases

- Carolyn Leslie, of Bellwether, noted that “there may be additional factors that explain the limited impact. On top of class “A” tenants’ need for bespoke office space, subleases are generally larger than what is in demand, remaining term is short, and some sublessors that have listed space might not be motivated to transact on it.”

Sublease vs. Direct Office Leases