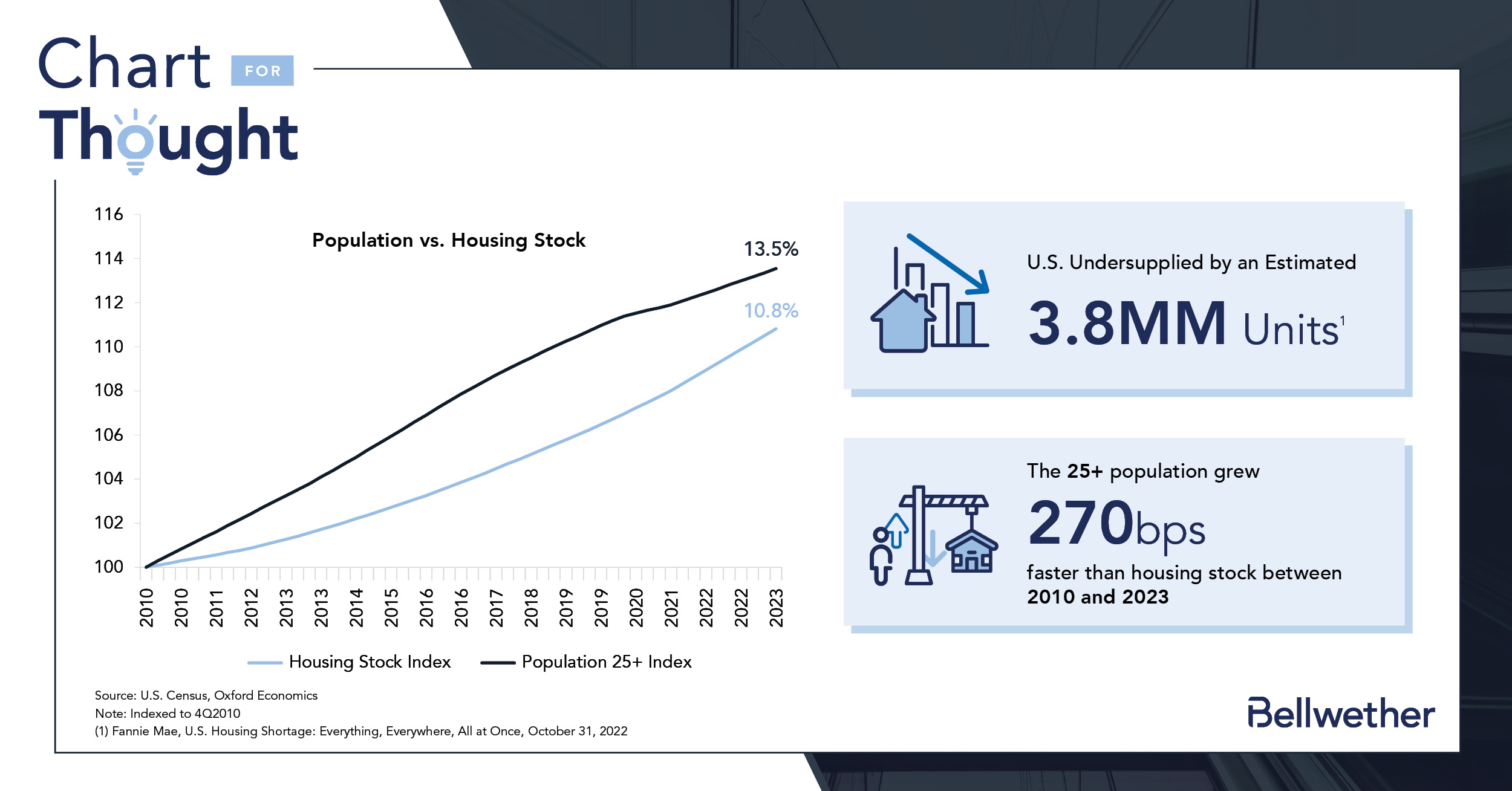

- The 25-year-old+ population, which is typically the starting age of new household formation, grew by 13.5%. Meanwhile, housing stock, which includes multi-family and single-family units, only grew 10.8%.

- The addition of new adults to the U.S. economy could put greater pressure on a housing stock that Fannie Mae already estimated is undersupplied by 3.8 million units in 2019[i].

- While there were 1.4 million housing starts at the end of 2023[ii], this does not account for obsolete homes being removed from the housing stock and will do little to alleviate this U.S. housing shortage. Additionally, signs point to fewer housing starts across the U.S. over the next two years, as an increase in construction costs have limited developer and homebuilder activity.

- In the medium term, the dearth of new housing supply and the presence of strong demand is likely to maintain pressure on affordability for both renters and buyers.

[i] Fannie Mae, U.S.Housing Shortage: Everything, Everywhere, All at Once, October 31, 2022

[ii] John Burns Real Estate Consulting